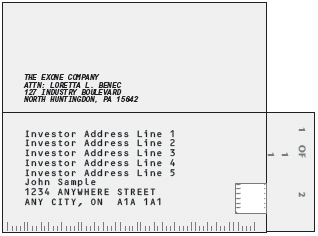

The ExOne Company

127 Industry Boulevard

North Huntingdon, Pennsylvania 15642

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held On May 16, 201813, 2020

Dear Stockholder:

You are cordially invited to attend the 20182020 Annual Meeting of Stockholders of The ExOne Company (“ExOne” or the “Company”). The meeting will be held on May 16, 201813, 2020 at 10:00 a.m., Eastern Daylight Time, at ExOne’s principal executive offices, 127 Industry Boulevard, North Huntingdon, Pennsylvania 15642.* At the meeting, holders of ExOne’s issued and outstanding common stock (NASDAQ:(Nasdaq: XONE) will act upon the following matters:

(1) Election of six (6)eight (8) nominees to the Company’s Board of Directors identified in the accompanying Proxy Statement, each for a term that expires in 2019;2021;

(2) Ratification of the appointment of Schneider Downs & Co., Inc. as ExOne’sthe Company’s independent registered public accounting firm for the year ending December 31, 2018; and2020;

(3) Approval of an amendment to the Company’s Certificate of Incorporation to specifically provide for stockholder removal of directors either with or without cause;

(4) Approval, on anon-binding advisory basis, of the compensation paid to the Company’s named executive officers in 2019, as reported in the accompanying Proxy Statement; and

(5) Any other matters that properly come before the meeting.

The record date for the Annual Meeting is March 19, 2018.16, 2020. Only stockholders of record at the close of business on that date are entitled to receive notice of, to attend and to vote at, the Annual Meeting and any postponements or adjournments thereof.

This year, weWe are pleased to deliver our proxy materials to stockholders primarily over the Internet. Utilizing Internet delivery allows us to distribute our proxy materials in an environmentally responsible and cost-effective manner. On April 5, 2018,3, 2020, we mailed a Notice of Internet Availability of Proxy Materials (the “Internet Notice”) to certain holders of record as of the record date, and posted our proxy materials on the website referenced in the Internet Notice. The Internet Notice explains how to access the proxy materials and the 20172019 Annual Report, free of charge, through the website described in the Internet Notice. The Internet Notice and website also provide information regarding how you may request to receive proxy materials in printed form by mail or electronically by email for this meeting and on an ongoing basis.

If you received your Annual Meeting materials by mail, the Proxy Statement, 20172019 Annual Report, Notice of Annual Meeting and proxy card were enclosed. Your vote is very important, and we appreciate you taking the time to vote promptly. The proxy card contains instructions on how to vote by proxy, by telephone or through the Internet, or you may complete, sign and return the proxy card by mail.

It is very important that your shares are represented at the Annual Meeting, whether or not you plan to attend in person. Accordingly, we request and urge you to review the proxy materials and vote your shares in advance of the meeting. If you decide to attend the Annual Meeting, and wish to vote in person, you may do so by revoking your proxy at that time. Also, if you plan to attend the meeting in person and need directions, please contact the office of the General Counsel and Corporate Secretary at(724) 863-9663. To ensure your vote is counted at the Annual Meeting, please vote as promptly as possible.

By Order of the Board of Directors,

LORETTA L. BENEC General Counsel and Corporate Secretary

April |

*Special COVID-19 Note: We are monitoring the emerging public health impact of the coronavirus outbreak (COVID-19). The health and well-being of our employees, directors and stockholders are important. If public health developments warrant, we may determine it is necessary or appropriate to offer, or completely switch to, a virtual meeting format. Any such change will be announced in advance through a press release and the filing of additional proxy materials with the Securities and Exchange Commission. As always, we encourage you to vote your shares prior to the Annual Meeting.

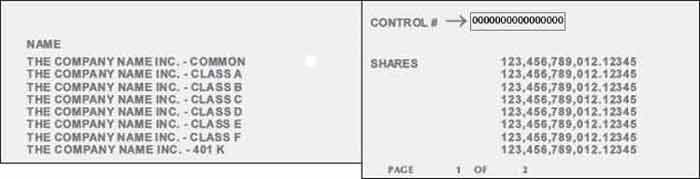

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR

THE STOCKHOLDER MEETING TO BE HELD ON MAY 16, 2018:13, 2020: OUR PROXY STATEMENT, 20172019

ANNUAL REPORT AND NOTICE OF ANNUAL MEETING ARE AVAILABLE WITH YOUR16-DIGIT

16-DIGITCONTROL NUMBER AT

HTTP://WWW.PROXYVOTE.COM.